Global Business Outlook for 2024

The global economy has had turbulent moments in recent years, but while economists say the worst is over, the market will remain volatile as it limps along towards recovery in 2024. In a recent study by the World Economic Forum, over 60 percent of chief economists worldwide foresee the economy continuing to weaken in 2024.

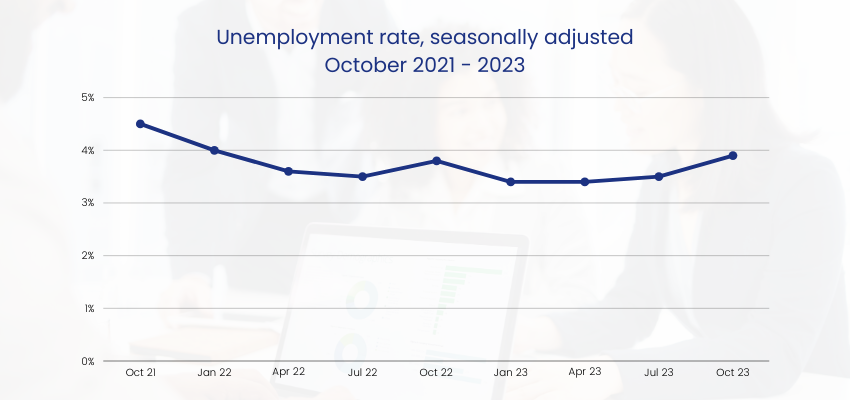

Labor markets are also expected to take a hit, with inflation and rising wages forcing companies to tighten their hiring budgets. In the US alone, job market growth lags at a dismal rate of 0.5 percent, with declining birthrates and an aging population as major contributors, according to the US Bureau of Labor and Statistics.

The lingering skills gap will exacerbate the effects of a small worker pool. In a recent study, the US Chamber of Commerce said all industries are experiencing a labor shortage except for particular sectors like nondurable goods manufacturing, wholesale and retail trade, construction, and transportation and utilities.

Amid low unemployment, the US and other western countries face sluggish job growth partly due to a troubled economy

Source: US Bureau of Labor & Statistics

The most vulnerable businesses to these labor market conditions are startups and midsized firms, as well as the companies in industries where attrition is highest, including hospitality, business services, finance, retail, and manufacturing. Equally vulnerable to these conditions is the technology sector due to the emerging roles needed to keep up with new innovations.

Outsourcing in a recovering economy

Economic uncertainties, geopolitical upheavals, and changing labor market dynamics are forcing businesses to look for cost-effective solutions to stay viable, efficient, and competitive. In countries like Australia, Canada, and UK, industries are relying on the influx of migrant workers to buffer labor shortages. But it fails to bring much-needed cost-effectiveness.

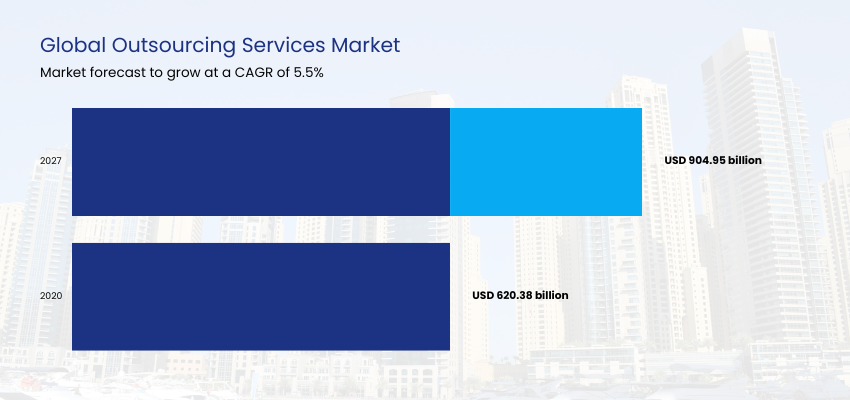

Market conditions provide a compelling reason for many companies to resort to the most viable strategy available: outsourcing. A Research and Markets study showed that global outsourcing services are forecast to grow to $904 billion in 2027 from just $602 billion in 2020, with an average annual growth of 5.5 percent.

“Businesses still need to operate amid economic turbulence. And one way to manage costs without compromising your service level and hamper growth is by outsourcing talent,” said Roy Figueroa, Emapta’s senior director for Global Growth. “Even when economies recover, companies that outsourced have seen their benefits.”

Unsurprisingly, the IT outsourcing market is expecting huge growth in 2024, fuelled by the need to find cost-effective talent solutions in the world of technology. Data from Industry Research showed that the IT outsourcing market size is poised to grow to $778 billion in revenues by 2028. Healthcare, telecommunications, and fintech industries will be the top users of IT outsourcing.

Huge opportunities in nearshoring

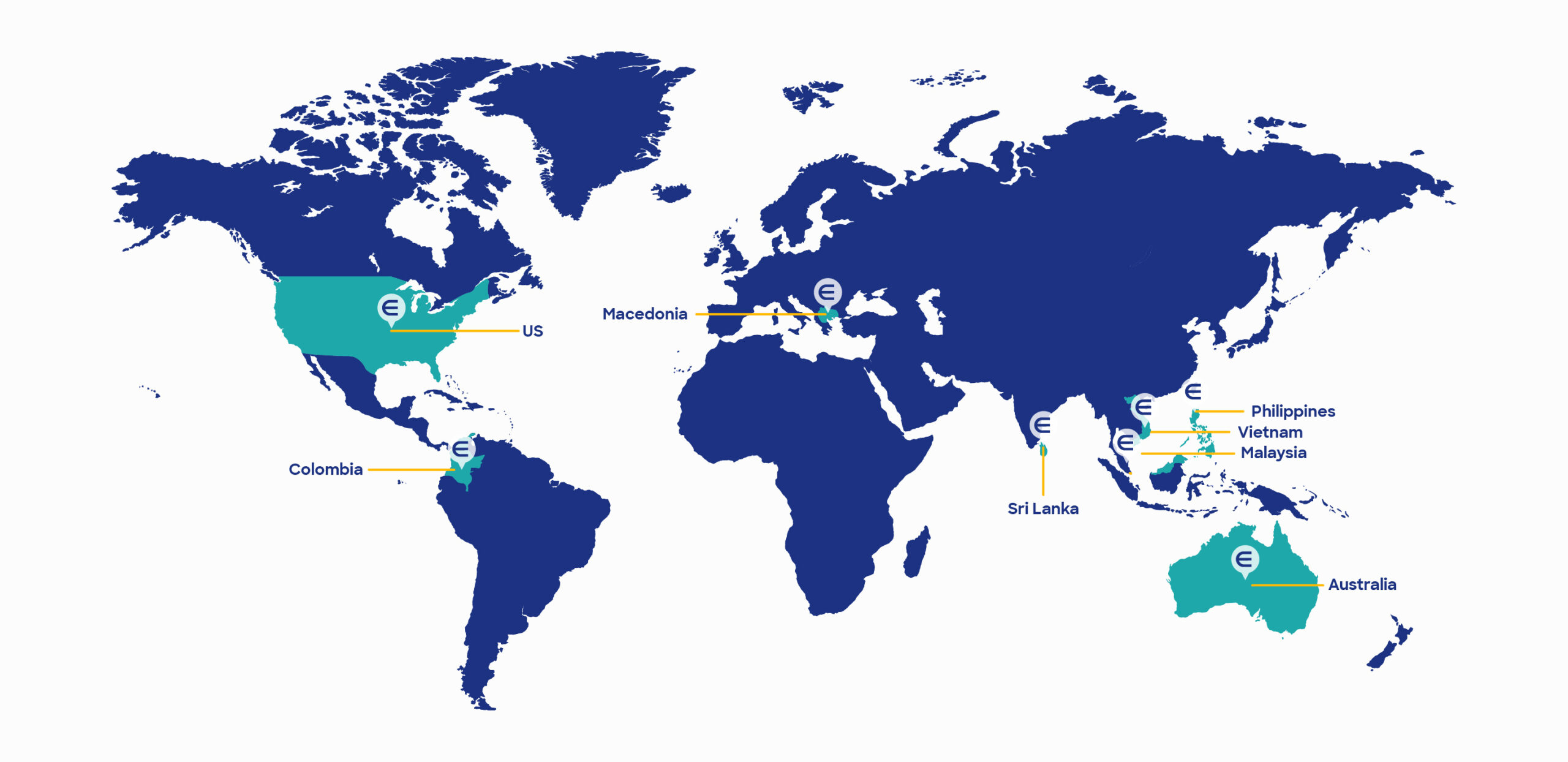

While the Philippines – considered as a leading hub for global outsourcing – is still expected to maintain its 5 percent annual growth until 2028. Other outsourcing markets near major countries are also seeing growth in the next few years. Latin America, for instance, is experiencing an upward trend in nearshoring.

Even companies in the United Kingdom are starting to explore talent pools within Europe to either augment their staffing needs or find cost-effective solutions as they traverse changing market trends and volatile economic conditions.

Emapta is in the perfect position to catch the winds of this emerging outsourcing trend. With offices strategically located in the Philippines, Colombia (Latin America), Macedonia (Europe), Sri Lanka, and now in Malaysia, customers will have more freedom to build the kind of team they want, whether full offshore, full nearshore, or a mix of both.

Figueroa said the company is planning to expand its Colombia operations with talent demands from the US growing significantly. He said businesses are beginning to see the benefits of nearshoring to neighboring regions, not just in talent reach, but also cost-effective employment models with time zone and cultural compatibilities.

With a crowded Mexico outsourcing market, Colombia continues to grow as a primary source of talent for US businesses, particularly in IT. The country offers skilled, English-speaking professionals with high cultural affinity, working within the same time zone as the US workforce.

“Colombia is going to be EMAPTA’s biggest site outside the Philippines with at least 2,000 employees in the next four years,” Figueroa explained.

Looking ahead: AI and outsourcing

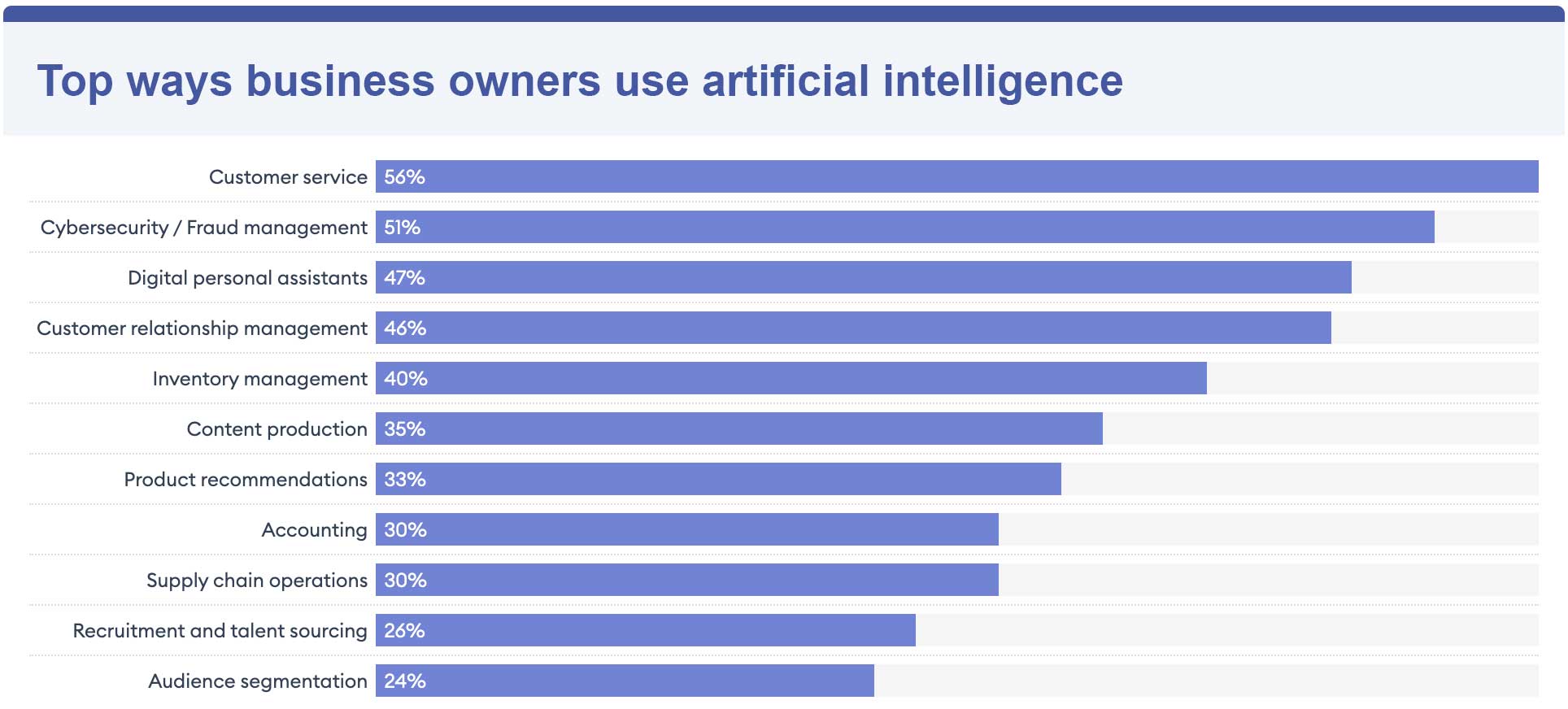

Artificial Intelligence (AI) and machine learning has seen growing adoption in the outsourcing industry as companies continue to look for ways to incorporate these in their operations.

In a recent Forbes survey, 97% of businesses expect AI tools like ChatGPT to help increase their productivity, while almost a quarter have begun to adopt AI to supplement their workforce.

Source: Forbes Advisor

More companies are now seeking new talent with specific expertise in applying AI technology. McKinsey reports that more than 35% of businesses have hired software and data engineers for AI-related positions since 2022.

Emapta is incorporating existing and bespoke AI technology into its daily operations with massive innovation projects in 2023 and 2024.