The Filipino accountant: A strategic partner for US tax firms

Outsourcing accounting may seem like a risky move, but in truth, finance and accounting are some of the most outsourced processes in the United States, with at least 37% of businesses seeking talent support offshore.

In fact, the global accounting outsourcing space is expected to reach $110 billion by 2030 with an annual growth of 9.1%, with the Philippines being one of the top talent resources in the world, as it continues to offer a surprisingly deep pool of US-trained and experienced accounting professionals.

This expertise stems from the country’s long history as an outsourcing pioneer, where Filipino talent got exposed to the American business model, particularly to the US Generally Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) for accounting, as early as the 1990s.

As a result, many Filipino accountants today have rich backgrounds in US accounting, taxation, and legislation, making them ideal partners for American firms.

The cultural factor

Beyond the rich knowledge, what allowed Filipino accountants to thrive in working alongside US accounting firms is their affinity with the American culture. This is because the Philippines has been the longest and closest allies of the US, practically leaving an indelible mark on the Filipino culture since Americans first came to Manila at the end of the 19th century.

American culture has been embedded so deeply into the Filipino culture, that English has become a national language in the Philippines. Even the primary mode of communication at school and at work has been English for decades. This is why a lot of US firms, especially early on, were surprised how easy it was working and communicating with their Filipino accounting teams.

In fact, since the early 2000s, many Filipino certified public accountants have found success in their accounting careers in the US, most of them eventually becoming American CPAs. But in those years, there have been more accountants who have helped American firms by working remotely with the help of trusted offshore outsourcing firms.

READ MORE: Comparing accountants in US, UK, Australia, Philippines

International-oriented accounting education

The strong cultural ties between the two ally countries also resulted in the Philippine accounting education being heavily influenced by the US. The Philippine accounting system follows existing US models. And in recent years, the Philippines has slowly adapted international frameworks to its accounting education.

After graduation, most of the Filipino accountants take on roles in the big accounting firms in the Philippines. These agencies are often partners of global firms like Ernst & Young, Deloitte, PWC, KPMG, Grant Thornton, and more, exposing fresh graduates to the world of US and international accounting.

It is in these agencies where Filipino accounting professionals take on various roles in the different accounting processes, handling several US clients all at the same time, especially during tax season. The experience here practically trains and hones them in international accounting procedures, including financial statements, tax computation, and tax return, and more.

A reliable option for US accounting firms

The availability of US-ready talent offshore has been a breath of fresh air for many American firms struggling with the nagging skills gap and economic downturns. In the last few decades, many US accounting firms have successfully built their teams in the Philippines, which allowed them to thrive amid volatile market conditions.

While the number of US accountants continue to dwindle down, the number of accounting and business administration graduates in the Philippines continue to grow. According to the Philippines’ Commission on Higher Education, at least 233,000 Filipinos graduated with an accounting or business administration degree- in 2019, marking a 4% annual growth rate for a 9-year period.

More than 2,000 Filipino accounting graduates also pass the national CPA licensure exams annually, according to the country’s Professional Regulatory Commission. CPAs or not, Filipino accountants readily take their talent to international audit firms to train and get global business exposure early in their careers.

READ MORE: Outsourcing Bookkeeping Services, Is It Worth It?

Where US-ready accounting talent meets cost-savings

Beyond talent, the Filipino accounting talent pool provides cost-efficient solutions for US firms due to lower salary costs.

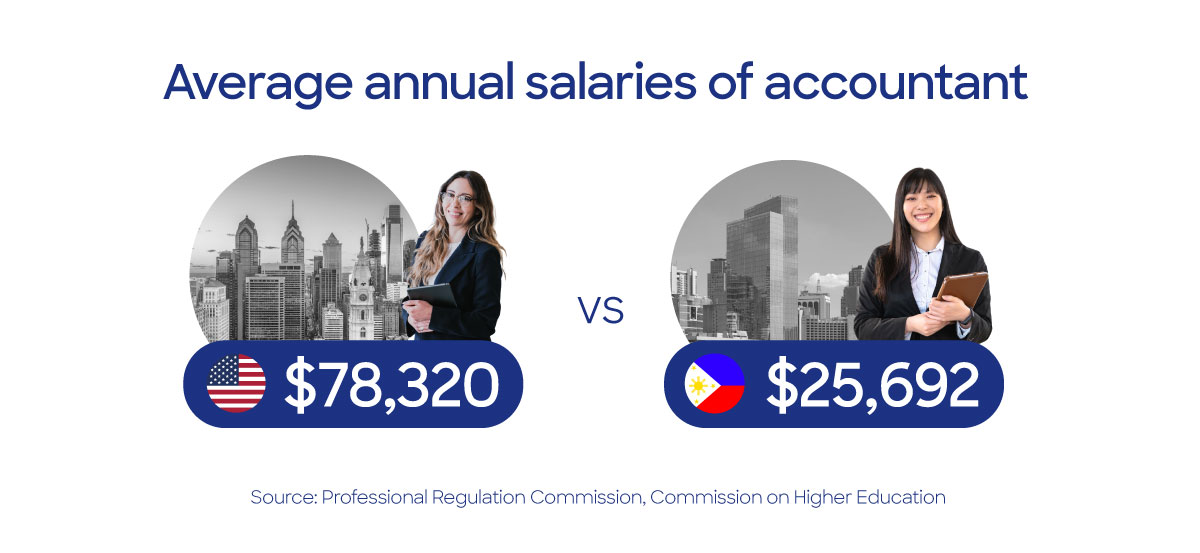

Data from the Bureau of Labor Statistics show that the average annual rate for US accountants reached at least $78,320 in 2022. Compare that to the $25,692 average annual pay for US trained and experienced Filipino accountants and you get at least 67% in savings.

The difference in pay between the United States and the Philippines is mainly because of the lower cost of living in Manila. Food, commodities, rent, and utilities are significantly less expensive in the Philippines, even in business districts, compared to the rates in major American cities.

And while salaries have been rising in the last few years around the globe, the rate of increase in the Philippines is much slower than the US.

READ MORE: Latin America: An emerging outsourcing hub

More accounting talent hotspots for US firms

As the world of business continues to become globalized, more and more countries beyond the Philippines are able to offer US-ready accounting talent. Countries like Sri Lanka and Malaysia have become offshore hotspots for cost-effective accounting talent solutions in the last few years, offering US-trained, English-speaking accountants, bookkeepers, and auditors.

Even nearshore talent hubs have started to offer experienced accountants and auditors ready to fit right into the system and culture of US accounting firms. Colombia, for example, has been a rising accounting talent hub in Latin America, providing deeper options, especially now that the outsourcing market in traditional destinations like Mexico are becoming saturated.

Opportunities for cost-efficient talent solutions have also opened up in Eastern Europe. North Macedonia, for one, has US-ready accounting talent to offer as the country’s education has evolved into a more international model. The best part of building accounting talent in Macedonia is that it’s just 6 hours ahead of New York time, basically in-sync with most US time zones.

There are already established and emerging accounting talent pools around the world to help US firms thrive and grow in uncertain market conditions. By tapping into the potential of skilled professionals across borders, firms can ensure access to the best talent globally. It will not only address the current accounting skills gap but pave the way for a more resilient workforce model – one that can adapt to market shifts while maintaining the highest quality standards.