Accountants in US, UK, Australia, Philippines: What’s the Difference?

Many businesses found growth and success with the help of certified public accountants in the Philippines. Despite the differences in accounting standards and regulations, Filipino CPAs tend to be the choice for many organisations across the globe because of two things: cost-efficiency and high adaptability.

Still, some companies across the globe can be hesitant to outsource accounting roles to the Philippines due to the lack of knowledge on how accounting in the Philippines compares to the other major countries. To shed light on how outsourcing can work for your accounting functions, here are some key differences between the accountants in the US, UK, Australia, and the Philippines.

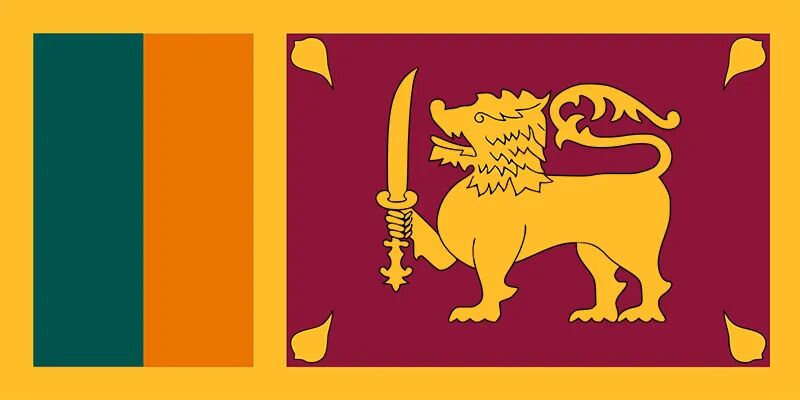

Accountants in the US, UK, Australia, and the Philippines are similar, but they do have slight differences.

Becoming an accountant in the UK

The road to becoming an accountant in the United Kingdom typically begins in a university, taking at least 3 years to get a bachelor’s degree. But with rising student debts, many aspirants turn to the Association of Accounting Technicians (AAT) to get their qualifications.

In 6 months, one can get an AAT certificate and land an entry-level accounting job such as accounts administrator, bookkeeper, tax assistant, sales ledger clerk, and more. Getting an AAT Professional Accounting Diploma, which could take 18 months, can get one into higher roles, like senior bookkeeper, tax supervisor, and commercial analyst, among others.

With a degree or an ATT diploma, an aspiring accountant in the UK can get accreditation from several accounting bodies. One of these is the Association of Chartered Certified Accountants (ACCA), one of the most prestigious and internationally-recognised chartered accountancy bodies in the globe.To become a chartered accountant, ACCA’s minimum requirements are 2 A-Levels and 3 General Certificates of Secondary Education, with Math and English subjects, or the equivalent. An accountant must pay a 1-time registration of £89 (around US$ 120), an annual subscription fee of £112 (around US$ 150) to become an active ACCA student. It may take up to 5 to 10 years to become complete the full ACCA qualification, depending on one’s pace, because it includes passing 14 exams and finishing 3 years of related work experience.

Some accountants in the UK prefer to get an ACA certification from the Institute of Chartered Accountants in England and Wales (ICAEW), which takes about the same time to finish. While ACCA is focused on management accounting, auditing, accounting, and taxation, ACA specialises in financial management, tax compliance, as well as accounting and reporting. Others, meanwhile, who want to focus on public accounting choose to get certification from the Institute of Public and Finance Accountancy (CIPFA).

Other accreditations in the UK include certifications from the Chartered Institute of Management Accountants (CIMA) and the Institute of Chartered Accountants of Scotland (ICAS). Chartered accountants in the UK can take on higher-paying roles like forensic accountant, financial risk analyst, business advisor, tax inspector, and tax adviser, among others.

While certifications in the UK are mostly internationally recognised, chartered accountants will still have to take the Certified Public Accountant exams in the US if they wish to take their qualifications there. There are some states, however, that have already provided ACCA exceptions for chartered accountants from the UK.

The American accountant’s journey

The first step in becoming an accountant in the US is getting a 4-year college degree in accounting, covering subjects like advanced maths, economics, business, as well as basic and advanced accounting courses. Because of the meticulous nature of courses in the US, most accounting students find support systems in university organisations like finance clubs and mock investment teams.

With a degree in accounting, one can already take entry-level roles, such as bookkeeper, accounts payable specialist, and senior accountants. The next step in the American accountant’s journey is to become a certified public accountant (CPA), which is a license for practitioners who want to focus on public accounting. Becoming a CPA in the US, however, can be a bit confusing at the start, but the requirements boil down to education, exams, and experience.

Once you get a degree, an accountant must pass the Uniform CPA exams, one of the most difficult professional exams with an average of 50% passing rate. After passing the test, a CPA can only proceed to practice after getting a license from the state where they plan to work. Many states require accountants to have a 2-year work experience before granting a license, but some require at least 3 to 5 years.

In summary, becoming a practicing CPA after college can take at least 1 full year because of the work experience requirement. American CPAs do not only have better chances of landing a job in the “Big 4” accounting firms, they can also carry their qualifications to countries with mutual recognition agreements. CPAs from the US can practice in Canada, Mexico, Australia, New Zealand, Ireland, and Hong Kong, and vice versa.

For broader opportunities, some CPAs in the US choose to combine it with a Certified Management Accountant certification (CMA). CMA is considered as the “gold standard” of management accounting certifications and having one can help CPAs transition from public accounting to private or management practice. American CMAs can also go global as the certification is recognised in China, India, UK, Canada, Middle East countries.

To be a CMA candidate, accountants must have a degree, 2 years of work experience in management accounting or financial management, and an Institute of Management Accountants membership. It takes at least 2 years to finish the CMA program, which includes passing a 2-part exam that covers 12 competencies.

Accounting in Australia

The accounting route for aspirants in Australia begins in college which may take at least 3 years of full-time study. Australia is home to three global top-20 universities for accounting: The University of New South Wales, the University of Melbourne, and the University of Sydney. Subjects covered in Australian accounting courses include accounting principles, administration, auditing, tax laws, corporate reporting, as well as public and managerial accounting.

After completing college, accountants may gun for a Certified Practising Accountant (CPA) certification, which requires a bachelor’s degree in accounting in an accredited college or university. Aspiring CPAs have 6 years to complete the whole program, which includes compulsory subjects in ethics and governance, strategic accounting management, financial reporting, and global strategy and leadership.

The CPA program also allows aspirants to select 2 electives, such as advanced audit and assurance, contemporary business issues, financial risk management, Australia taxation, digital finance, and more. Recognised in many countries across the globe, being a CPA in Australia is seen as a mark of “high professional competence” in the accounting industry.

Some practitioners in Australia choose to become chartered accountants (CA) to focus on the more technical aspect of accounting. The CA program, which has similar entry requirements with CPA Australia, is composed of 5 academic modules that can be finished in 18 months to 2 years. Aspiring CAs must complete 3 years of mentoring experience.

Both CPA and CA certifications have their merits. CPA has a broader focus on accounting and business management, while CA focuses more on the technical aspects of accounting and tax.

The Filipino Accountant

Aspiring accountants usually take a 4 to 5-year course in college to get a degree. College covers the same standard subjects tackled by accounting students in the US, UK, and Australia. Right off the bat, accounting graduates are ready to take on entry roles, but many of them in the Philippines choose to take a year-long review for the certified public accountant exams.

Being a CPA in the Philippines is important for those who want to take their careers to another level. It is also seen as an indication of deep knowledge in accounting. The CPA exam in the Philippines, which has a passing rate of around 42%, is a 4-part test that accountants can take within 18 months.

The Philippines produces at least 175,000 new CPAs and over 8,000 accounting professionals every year, which makes the country a top outsourcing destination. Filipino CPAs are not limited to practicing in their locality as they are recognised in the highly diverse countries of the ASEAN region, like Singapore, Thailand, Indonesia, and more. This makes Filipino accounting professionals very adaptable and quick in learning the standards and regulations of any country.

The Philippines and Australia have also set a pathway that Filipinos can take to become qualified Australian CPA. Because of the high demand for qualified accountants that coincided with a global talent gap, the Philippines has become a steady source of talent for the US, UK, and Australia.

READ MORE: 4 Reasons Why Smart Business Leaders Outsource Accounting Services

For the past couple of decades, accounting roles have been a top outsourced skill in the Philippines not only of cost-efficiency but also because of the level of Filipino’s proficiency. Filipino accountants are also quick to adapt to the culture of their partners abroad, making them easier to work with. The cost of accounting labour in the Philippines is also significantly lower than that of Australia, the US, or the UK mainly because of the difference in cost of living. A cup of coffee in Australia may cost a little bit higher than in the Philippines, and the same applies to wages.

The most important thing to do if you’re a business planning to outsource accounting roles to the Philippines is to find the right partner. Look for an outsourcing provider that will take the time to study your organisation’s pain points and prioritise your business goals. The best outsourcing partners in the Philippines will be able to provide you with talent that will match not only your exact needs, but also your company’s vision, identity, and culture.

READ MORE: 6 Secrets to Building a Successful Team in the Philippines