In-house, freelance, outsourced: Which accountant is right for your business?

Hiring in-house accountants may be the best option if there’s an abundance of talent around. Freelancers are always there, but they may be busy handling multiple clients. But what if you can get the best of both worlds?

Real talk: Do you really need accountants?

Before diving into the different ways of hiring accountants, let us first address the elephant in the room – do you really need to hire an accountant now?

Sure, some startups begin with zero accountants because the CEO or a VP usually handles the books. But it can only go on for so long. And you are not going to be a startup forever, right?

The goal of every business is to grow, and when growth comes, it usually comes hard and fast. It requires you to make quick decisions, craft better strategies, and focus on adding better value.

A sudden growth spurt would also require you to keep up with loads of processes – keeping records of finances, checking compliance, doing tax duties, ensuring proper payroll of a growing team, and more.

Usually, this is the point when most startups realise that they do need accountants, or even an entire finance department, to keep up with the growth.

Most of the time, this realisation comes too late. Companies would struggle to keep up with the fiscal management of the business, resulting in considerable losses.

A disruptive talent shortage

There is no doubt that accountants are essential in running a business. They are the experts, the numbers people, the ones taking care of finances and keeping your pockets in check.

But a global talent shortage has been making it hard for companies to find accountants. Worse, the shortage of accountants has driven rising salaries across the industry.

The result is daunting: Many companies are spending way more time looking to fill accounting positions while spending way more to keep the little that they find.

READ MORE: Payroll Outsourcing on the Rise: What’s Behind Its Growth?

The smarter companies, however, have found ways to get around this disruptive talent shortage. Some have resorted to hiring freelance accountants, while some have outsourced to other countries.

But if you would follow the lead of these businesses, you might wonder — which one do you need, a freelancer or an outsourced accountant? Or should you just stick with in-house staff?

Hiring in-house accountants

Having in-house accountants sounds like the best option if you want to hire a committed team to manage your accounting processes on a consistent, long-term engagement.

And for the most part, you’d be right. But it will require a comprehensive assessment on your end to determine if you have the time and resources needed to hire and keep them, given today’s talent shortage.

Take startups, for example. With limited resources at their disposal, they will have a tough time filling roles if they choose to go with in-house accountants.

For scaleups and established businesses, hiring in-house accountants may be a good option, given they have enough buffer in terms of time and finances.

When hiring in-house accountants, you want to look for someone with extensive experience and expertise, so you can focus on your core business in the long term.

However, it might be a challenge to accurately assess someone’s accounting skills without a thorough understanding of accounting. So, you might still need some external help in recruitment.

Hiring in-house accountants is the best option only if you have the money, time, expertise, and patience to look for one.

It’s a high-risk, high-reward campaign. Land the right talent and you get a long-term finance leader to help you reach your goals. Hire the wrong person, and you repeat the whole expensive hiring cycle.

READ MORE: Accountants in US, UK, Australia, Philippines: What’s the Difference?

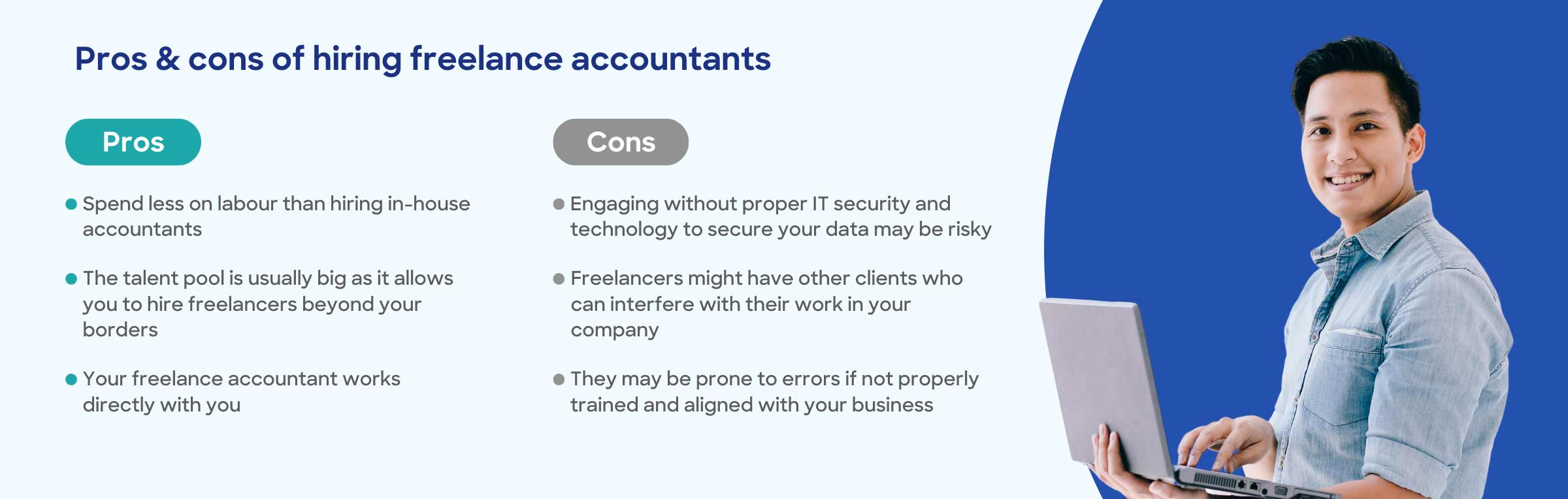

Hiring freelance accountants

If you already have an in-house accounting team but you need to address a sudden surge in demand, especially during peak or tax seasons, hiring freelancers can be a quick staffing fix.

Freelancing is a thing today. When most of the world went digital due to the pandemic, many accountants found earning opportunities through freelance work.

Freelancers who work in accounting, marketing, law, web development and other specialized fields make an estimated US$28 per hour. This is around 70 percent higher than all hourly wages in the US.

When you do the math, the amount you pay for freelance accountants is lower than recruiting in-house staff because of the overhead costs.

And because freelancing can be done virtually, it opens a huge gate to a global market of freelancers waiting to take on a job or two for you.

Yes, freelancers are everywhere. But finding one with the specific expertise that you need for your situation is an entirely different conversation.

Most of the time, businesses hire freelancers for short-term projects. But short-term agreements with various freelancers could lead to scattered books.

Some businesses do engage with freelancers for longer periods. But this is sort of an exception to the rule because freelancers usually take on short-term, multiple jobs to maximise the pay they can get.

Freelance vs. in-house vs. outsourced accountants

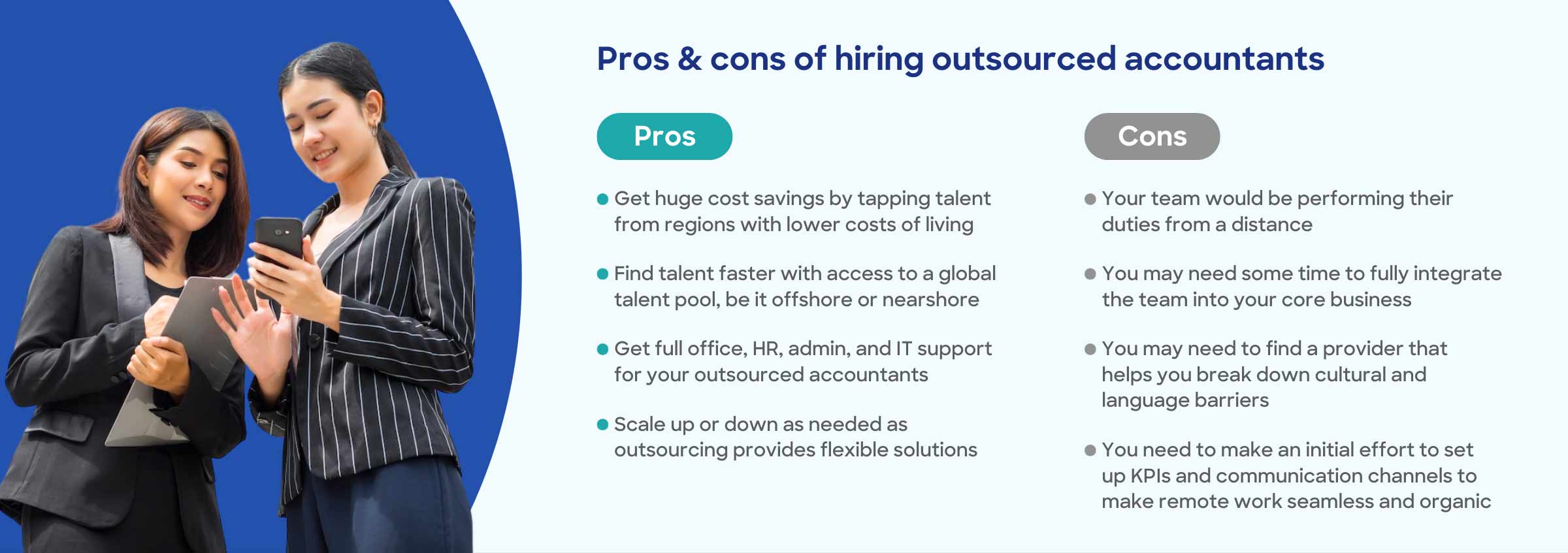

If you need the experience and expertise of a local accounting talent plus the availability and cost-efficiency of freelancers, then outsourcing your accounting to the Philippines can be your best option.

First, outsourcing allows you to access a global talent pool, ensuring that you can hire the accountant you need faster than hiring locally.

Outsourcing providers typically maintain pools of certified talent where they source the accountants that match your required qualifications, such as certifications and tool proficiencies.

In the Philippines alone, one of the world’s top outsourcing hubs, there is an abundance of highly-skilled labour – from junior and senior bookkeepers, billers, CPAs, to paraplanners, payroll specialists, financial advisers, and analysts.

READ MORE: Outsourcing Bookkeeping Services, Is It Worth It?

READ MORE: Outsourcing vs subcontracting

Beyond hiring, reputable providers even help you with onboarding and supporting your team, from workspaces, secure IT infrastructures, HR and admin support, training, upskilling, and more.

Whether you want accountants to augment your in-house staff during tax season or you want a dedicated team for your startup venture, outsourcing is flexible enough to deliver talent for you.

Some providers even give you the option to outsource offshore or nearshore (or both), depending on your needs.

Finding the right outsourcing partner

In trying to leverage the global talent pool to sustain and grow your business, finding the right outsourcing partner is crucial.

The best outsourcing partners give you enough flexibility and control to incorporate your brand, identity, and vision into your offshore team while offering the best available talent.

They allow you to hire accountants who can perform both clerical and core business tasks because accounting is more than just crunching numbers.

There are many outsourcing companies in the world, but only a few of them are dedicated to resolving your pain points as if they were their own.

But for you to find the right partner, you need to figure out first the specific problems and needs that you need to address – the ultimate reason why you outsource.

Start with providers from top outsourcing destinations like India or the Philippines or even emerging outsourcing hubs like Sri Lanka, Colombia, and Macedonia.

READ MORE: How to outsource to the Philippines

Consult with multiple providers, lay down your goals and pain points, and ask them for a specific action plan moving forward.

In the end, choose the provider that understands your business and provides the right tailor-fit solutions it needs.