Of Debts and Balances: Why Outsource Credit Control

What is credit control?

As a business, you would always want to get customer payments on time. And smart entrepreneurs know that you can’t just leave credit payments to chance, even if you are handling a small business. That’s why many business leaders are making the smart choice to outsource credit control.

To understand the potential benefits of outsourcing credit control, there must first be a clear understanding of the importance of credit management to the cash flow of a company because many still believe that credit control is a function for big businesses alone.

Credit control is a strategy adopted by a company wherein it seeks to increase sales by offering a range of credit options to potential customers. Better credit options go to prospects with “good” credit records, while limited credit options go to those with “weak” credit records.

Not all customers have the same behaviour in paying debt. Some pay on time, while others need to be reminded occasionally. In worst cases, some customers would try to evade paying debt on certain periods due to various reasons, such as personal financial difficulties.

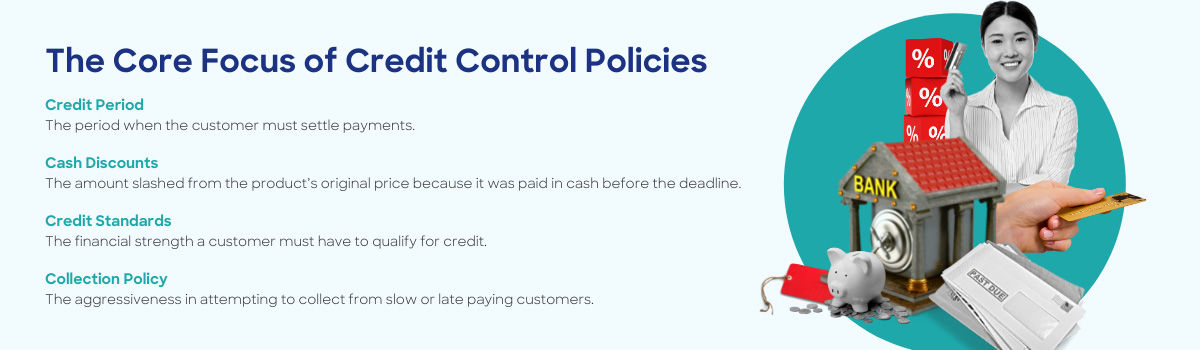

It is the unpredictability of credit payments that pushes companies to draft credit control policies. This balances all variables, giving customers affordable means to purchase a product or service while ensuring proper and timely payments are made.

Credit control measures also include evaluating the creditworthiness of prospects before allowing them to make a credit. This process takes a little time, but it puts some level of security and assurance on the side of the businessman.

When customers are happy and payments are on time, both cash flow and sales are healthy. On the flip side, piling debts from slow-paying customers will just offset any increase in sales, and what follows could be an endless game of catch-up – chasing after payments with no real structural solutions.

Outsourcing credit control, does it work?

Some companies think that credit control is just for big businesses because early in the life of an organisation, the number of customers is enough. But there will always be a time of growth, and a startup would offer credit to a few people until it blows out of proportion and credit control is needed.

Other small companies hesitate to add a credit control function because they lack the size and expertise to have one. Their in-house accountants are busy with all the core tasks. In some cases, the executives themselves track all the credits, making them neglect some of their core duties.

As the adage goes, some people work hard and some work smart, and businesses that wanted to work smart chose to outsource credit control. By outsourcing credit control, a company leaves management of debt policies to the hands of experts.

Outsourcing providers that specialise in finance have access to certified professionals that can perform various credit control roles. Including pre-due date verification calls, monitoring lapsed payment dates, follow-up calls, handling and escalation of disputes, doing in-depth credit reports, and more.

Here are some of the benefits of outsourcing credit control:

Reduced bad debt

Bad debt is a debt that can no longer be recovered, so companies list it off as an expense instead. Bad debts usually happen because of neglect or inability to manage credit. By outsourcing credit control, you get a team of experts whose focus is ensuring every debt is monitored and paid accordingly.

Healthy cash flow

Cash flow is like blood to a business and debts left unmonitored on the wayside are like cholesterol clogging the veins. With an outsourced team of professionals looking after all the debts, you have the peace of mind that cash flow is healthy.

Skill and expertise

Hiring certified professionals can be difficult for smaller companies trying to make ends meet to grow the business. But an outsourcing partner provides access to global talent, helping a company find certified and experienced professionals to match their exact requirements for the role.

Reliable processes

Aside from talent, outsourcing providers also allow companies to access technologies and systems to support their credit control team. With technology and business continuity measures in place, having an outsourced team today is seamless as having an office extension in another place.

Flexibility to scale

Outsourcing allows you to build a team of credit control experts and scale up or down when needed. Modern outsourcing models also allow companies to get customised solutions tailor-fit to resolve their specific pain points, which means you can hire individuals for a specific role or a whole team.

Reduced costs

Outsourcing providers source talent from countries with lower costs of living, allowing companies to save more budget for other important aspects of the business. The cost of outsourcing talent is way lower than hiring on your own, especially when you consider the whole recruitment process.

Focus on core business

With a team of experts handling debt and payments, business leaders no longer have to worry about credit. They could instead turn their full uninterrupted focus on high-value functions, such as analysing and strategising for business growth.

Outsource credit control the right way

Of course, outsourcing is not a cure-all magic potion to make all debts disappear. It is a process that takes time, effort, and transparency from both the company and the provider. The success of outsourcing depends on the willingness of both sides to make it work.

To make the most of outsourcing, make sure to identify your specific needs first. Do you need to outsource the whole credit control process, or just some of its functions as you have a capable in-house staff to handle the other roles?

Would you want to outsource for cost reduction or access to niche talent? Would you want to outsource because of a sudden increase in demand or just to offload some tasks from your core team? Your purpose of outsourcing will guide you as you find the right partner.

READ MORE: Outsourcing in the Philippines: A Guide for Businesses

Do consider outsourcing offshore because not only can partners there provide a wide range of roles, but they also have lower costs. In the Philippines for example, the average annual salary of accountants is at $6,000, far from the $49,000 average in the US.

The Philippines could even be a good lead for outsourcing highly skilled accountants to handle your credit control functions because the country produces thousands of certified public accountants every year. Manila values experience when it comes to CPA, so you know you’re getting quality people there.

When you find a partner, ask whether it can deliver on your specific requirements. Research about its records, clients, and capabilities to give you a hint of how the provider works. If available, ask for an independent audit of its processes and security to make sure you are partnering with a reliable provider.