Are rising costs killing your business? Here’s how to survive rapid inflation

The impact of rising inflation may not be immediate in certain industries. But sooner or later, every business gets hit.

Inflation effect on small businesses

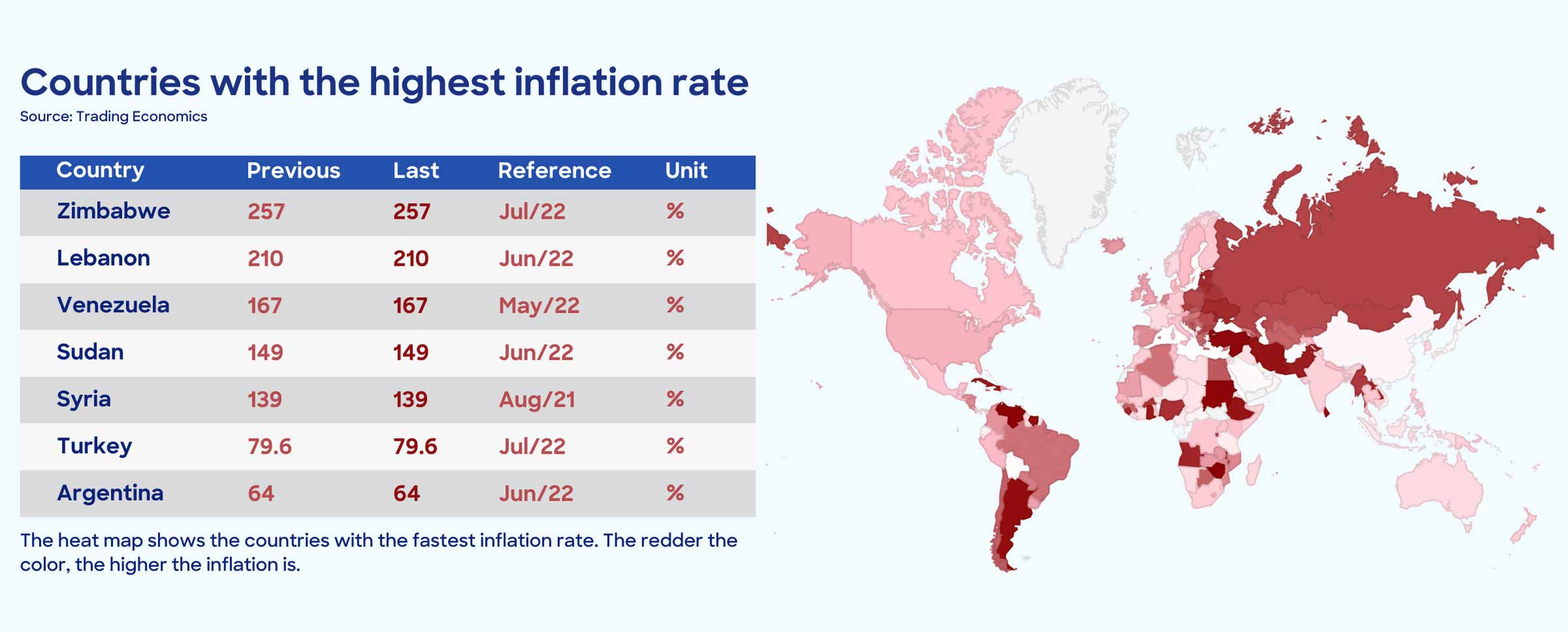

Businesses in many countries are struggling to cope with shifting markets as prices of basic commodities continue to soar at record-high levels.

Just last May, inflation in both the United States and the United Kingdom reached a four-decade high, raising the prices of gas and other essential goods.

Still trying to rebound from their pandemic losses, small businesses are among the first sectors to feel the effects of fast-rising inflation.

Inflation limits the purchasing power of small businesses, forcing them to raise the prices of their products and absorb losses in their profits.

Many businesses are also having huge problems with the shortage of certain supplies that they need for their products and services.

For the affected entrepreneurs, the most immediate and logical action to take is to strategize, both for short- and long-term goals.

How to survive inflation

Inflation is not a new phenomenon, and there are ways to survive challenging times like these without incurring too many losses. Here are a few ideas that may help you tame surging inflation.

Raise prices strategically

Raising prices is inevitable during long periods of inflation, but it does not have to be an increase across the board.

Instead of driving away potential and loyal customers with big-time price hikes, you may want to begin with auditing your product pricing.

Divide pricing data into segments, determine all the factors that affect your pricing, identify profit leakages, and make the most logical pricing adjustments.

Just remember that in making price adjustments, communication is always key. Customers must know why you are raising prices and why it is necessary.

Refine your business operations

When you are battling inflation, it helps to know your own strengths and weaknesses before creating and executing solutions.

Many leaders begin by identifying the most profitable parts of their business so they can put most of their focus there while cutting the costs on the least profitable ones.

You can also identify production materials that are affected by supply chain disruptions and consider alternative options.

A closer look at your business operations would help you determine areas where you can cut costs and areas where you can double down to offset possible losses.

Stock up on essentials

Stay updated on the latest news and gauge how long the inflation may last. If it looks like it’s going to last longer, stock up on the essential materials that you may need.

Chances are, the price of these supplies will go up in months to come, so filling your warehouse with stocks would buy you time to prepare for a long bout against inflation.

Keep the people happy

It may sound too simplistic but keeping your employees happy and fulfilled during a long bout against inflation is a lifesaver, especially now that “The Great Resignation” is not yet over.

Markets from many countries are experiencing talent shortages, so losing employees during inflation can be a fatal blow.

The cost of attrition is not something that can be taken lightly, so the least you can do is to keep your employees fairly compensated with comprehensive benefits.

Look after the health and wellness of your people because these are among the top factors that affect an employee’s decision to stay or leave.

Look for opportunities to save

Does your business model really require a physical office? Or is it possible to just rent a co-working space for certain days of the week where your remote workers need to meet and collaborate?

Are you paying for subscriptions that you don’t really need? Do you have costly processes that can be streamlined for cost-efficiency?

These are just some of the questions you can ask yourself when looking for areas within the business where you can save.

There are many technological and digital solutions that you can adopt to replace older and much more expensive tools and systems.

Outsourcing to combat inflation

Outsourcing allows businesses to access trained, experienced, and certified professionals at a much lower rate, helping them control labour costs.

For example, financial planning during inflation may require the full attention of your finance and accounting teams on creating strategies.

But doing so would mean sacrificing workflow efficiencies which may lead to delays and losses in certain business processes.

Instead of hiring additional headcounts, outsourcing accounting professionals to repetitive and administrative tasks at a much lower cost would be a more logical solution.

You get to create sound strategies to adapt to the changing times without burning cash, which would help you survive or even thrive during long periods of inflation.

Partnering with providers from top outsourcing destinations like the Philippines will allow you to get certified professionals at around 70% less.

Moreover, outsourcing companies also provide office space as well as tech and admin support for your team as part of the package.

Outsourcing does not only help you control labour costs. It also allows you to reduce overhead costs so you can save more as you battle inflation.