Australia’s construction crisis: Is your business at risk?

A ‘storm’ of market disruptions has led even established Australian construction firms to the path of insolvency. How do you survive this construction crisis?

Australia’s construction industry has been facing a wave of insolvencies as construction firms are being battered by what the media describes as a “perfect storm” of supply chain problems, lack of skilled labour, high material and supply costs, and severe weather events.

Just in 2021, construction companies accounted for 26 percent of businesses in Australia that entered insolvency, including major players such as Pruview, Hotondo Homes, and Metricon.

More recently, Gold Coast developer Nerang Street went into administration this September, owing creditors an estimated $80 million in debt.

Industry giant Probuild also filed for liquidation earlier this year, putting more than $5 billion worth of construction projects in limbo and hundreds of employees out of work.

Analysts do expect the construction crisis to ease in the near future as the bulk of unfinished construction projects in the country resume and with the incoming labour administration introducing a new wave of investments to shore up the economy.

However, the outlook remains grim for the long term as construction spending is expected to slow down and the effects of pandemic stimulus are starting to run dry.

Thus, executives in construction firms are under increasing urgency to assess the financial health of their organisations and take immediate action to prevent or at least mitigate potential insolvency.

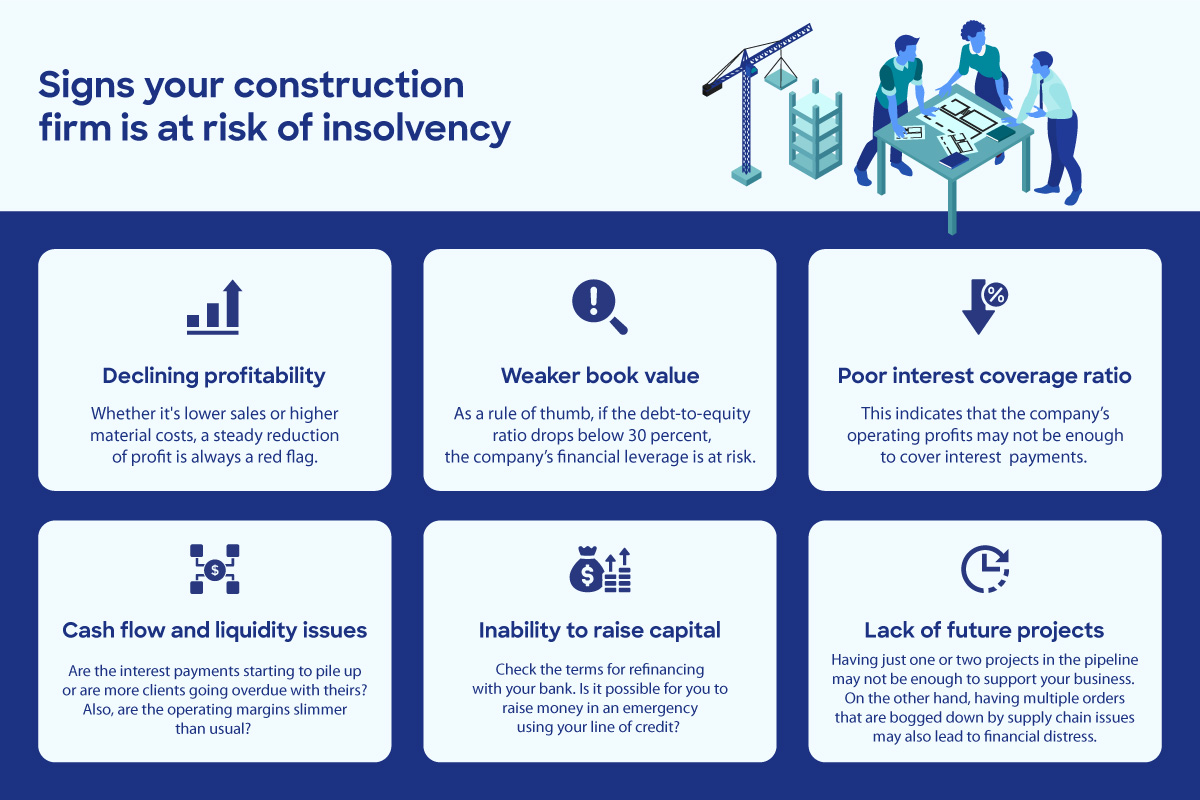

Assessing the risks

If you own or manage a construction business in Australia, there are several ways to assess if your organisation is at risk of insolvency. Here are some of the warning signs to watch out for.

Protecting your business from insolvency

If you have reason to believe your business is vulnerable to insolvency, here are ways to prevent and help mitigate risk:

Get professional help

The first and most important step for any business facing insolvency is to consult a licensed insolvency practitioner (IP), which is a fiduciary authorized to act on behalf of individuals and organizations facing insolvency or acute financial distress.

These actions include collecting company assets and preventing creditors from seizing them, reorganizing staff, and assisting in communicating with customers and lenders regarding the state of the company.

Insolvency practitioners in Australia also tend to be qualified accountants and are legally bound to act in the organisation’s best interests.

Find ways to cut costs

Business owners will have to make difficult decisions in times of financial distress, including cutting down on payroll and discretionary spending.

Supply chains may also need to be streamlined and credit terms with suppliers analyzed to see if they are in line with the rest of the industry.

You may also consider outsourcing administrative tasks such as payroll or accounting processes to third-party providers to further manage overhead costs of your workforce.

Review contracts

Evaluate key suppliers and other business contracts to see if the terms and conditions can be renegotiated to cover insolvency situations.

If possible, review these contracts immediately to give you a better position to negotiate in the event of insolvency.

It’s also highly recommended that companies maintain two-way communication with other parties mentioned in the contract to prevent confusion and ensure smoother negotiations.

Look for other sources of cash flow

Selling surplus assets and introducing additional services to strengthen your current portfolio are great ways to augment cash flow and profitability.

Also, experts recommend keeping an updated overview of your company’s cash flow, so you can determine the pros and cons of taking up such actions.

Go digital

Digitizing certain business functions can help reduce expenses in the long term while making processes more efficient and easier to document.

Partnering with outsourcing service providers is an excellent and cost-efficient way to access the latest digital tools as they usually include these in their service package offerings.

With the construction crisis not expected to improve any time soon, construction company owners and managers must be prepared to act quickly to protect the financial health of their organisation.

Whether it’s reducing expenses, diversifying services, or outsourcing costly business functions, adapting your business operations and finances to the changing economic climate could mean its survival and quick recovery in the future.